Spend Money or Lose It

Viscione’s article (as in Refernce section) pictures out how important is designing and implementing a continuously improving budget process, for any business firm to survive. He warns all business firms either small or big to build its budgeting system right from the beginning of first year of its inception. He suggests many helpful hints that a manager should consider to build and maintain a healthy and long-term budget system to manage money. The basic steps towards this are to allocate time and resources for formulating and evaluating targets of expenses and revenues, summarize the targets and increase the likelihood that the targets will be achieved (means targets should not be viewed as a “forecast” but something that he has to make happen), develop alternatives to each target, apply control measures to monitor progress each month or quarter and take corrective action if its deviates from the original goal of achieving profits from the targets (Viscione, 2000 ). This is the basic regulatory feature of any control process. In this case, we regulate and control the use of money.

My experience with directly involving in the budgeting process is very little, but I can easily relate what I understood from the article to one of my previous employer where I worked as a Project Leader. The organization structure was highly Bureaucratic in nature with the Governor on top followed by Chief Minister, then Secretaries for each specialized state department and the whole bunch of bureaucratic positions such as Directors, Joint-secretaries, Under-secretaries, Project Managers and other employees.

For applying the above mentioned steps to the fullest potential, the manager (the officials till the Under Secretary level, where I worked) should have strong support from his top management to oversee and delegate the budgetary responsibility. The responsibility and commitment should be clearly defined so that each budget category (sales, new product development, departmental projects, employee training for latest technology usage, facility improvement etc) is assigned to an appropriate manager who has full faith in the control process. The state budgeting process is greatly influenced by political and interest groups (citizens, industries, project agencies). This indirectly builds in top level support for the budgetary process. The budgeting process should not make everyone feel that he is the controller, even the manager. There should be generally one controller such as the President or CEO or sometimes a designated official called CFO. In my organization, the IT secretary was the person who had the powers to deal with budgets in the IT department. He devises the strategies for the department and allocates budgetary provisions for each department functions and for various projects. The IT mangers or the directors are given responsibility to set the targets and establish timeframes to achieve them. The idea is that the strategic planning and delegation should always come from the top level. The role of the manager is to make sure that the targets are achieved as assigned to him and take actions when budgetary system warns of a crisis.In this effort, it is useful for him to be aware of the various stakeholders who are either involved in execution of the budgetary process or who are affected by it.

The internal stakeholders include the President, CEO, IT Secretary (in my organization) and CFO (I assume he is who is referred to as “controller” in the article) at the top level who develops and oversees the overall budgetary strategies. Down the levels, we have the individual managers (my IT Manager) who actually “operate” and implement the targets and the employees (including me) who execute the individual tasks towards target achievement. The external stakeholders include company shareholders (are interested in the ultimate profits that budgets brings in, for e.g. the interest groups who have influenced the State budget), banks (are interested in the amounts invested or borrowed), customers or citizens (interested in value addition and prices tagged to the products and services that the company deliver during that budgetary period), budgetary consultants (e.g. CPA who consults on imparting knowledge on building and reshaping budgeting strategies), market environments (that determine the target areas of improvement and thus amount of money to be allocated) and competitors (for benchmarking).

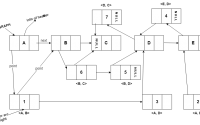

In my opinion, the bureaucratic or hierarchical structure, similar to the one which we had in the IT department, will tend to be more structured as far as setting up and controlling the budgetary process than a flat organization structure where everybody tries to (or sometimes has to) control. Also the manager will have clear responsibilities and boundaries to commit to. The IT department where I worked had department budgeting system which was integrated with the state wide Budget Information System. Each manager can login to the system wherein they can view the budget information for each project that they are handling, summarized target and timelines, monthly, quarterly and yearly projections of money usage per project, drilled down to project tasks. The system can also track progress as the project goes on through its life cycle and can warn him if the resource allocation deviates from the budgetary provisions and thus take corrective actions.

References:

Viscione J.A. (2000). “Small Company Budgets: Targets Are Key”. Harvard Business Review.